sales tax calculator buffalo ny

Divide tax percentage by 100. New York State Sales Tax.

When Will Ny Homeowners Get New Star Rebate Checks Syracuse Com

This includes the rates on the state county city and special levels.

. Rates include state county and city taxes. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875. Maximum Possible Sales Tax.

This includes the rates on the state county city and special levels. Ester Guylas Tax Service Inc. Zip code 14213 is located in Buffalo New York and has a.

The estimated 2022 sales tax rate for zip code 14211 is 875. New York Estate Tax. The estimated 2022 sales tax rate for zip code 14213 is 875.

The December 2020 total local sales tax rate was also 8750. The calculator will show you the total sales tax amount as well as the county city. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

2021 List of New York Local Sales Tax Rates. Name A - Z Sponsored Links. The current total local sales tax rate in Buffalo NY is 8750.

Multiply price by decimal. List price is 90 and tax percentage is 65. Bizzee Bee Bookkeeping and Payroll.

New Yorks estate tax is based on a. The Buffalo New York sales tax rate of 875 applies to the following 29 zip codes. The Erie County New York sales tax is 875 consisting of 400 New York state sales tax and 475 Erie County local sales taxesThe local sales tax consists of a 475 county sales tax.

If youre an online business you can connect TaxJar directly to your shopping cart. The price of the coffee maker is 70 and your state sales tax is 65. Zip code 14240 is located in Buffalo New York.

The New York sales tax rate is currently. This includes the rates on the state county city and special levels. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income tax deduction. Average Local State Sales Tax. The latest sales tax rates for cities in New York NY state.

You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. The minimum combined 2022 sales tax rate for Buffalo New York is. This includes the rates on the state county city and special levels.

Sales tax applies to retail sales of certain tangible. Sales Tax Calculator in Buffalo NY. Maximum Local Sales Tax.

Sales Tax Calculator in Buffalo NY. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code. The recently enacted New York State budget suspended certain taxes on motor fuel and diesel motor fuel effective June 1 2022.

The average cumulative sales tax rate in New York New York is 888. 65 100 0065. Before-tax price sale tax rate and final or after-tax price.

Name A - Z Sponsored Links. Zip code 14211 is located in Buffalo New York and has a. Pursuant to the New York State Real Property Tax Law The Department of Assessment and Taxation is responsible for the implementation of a fair and equitable.

New York is located within New York. The estimated 2022 sales tax rate for zip code 14240 is 875.

Buffalo S Billion Dollar Tax Fumble

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Antique Cary Safe Co Buffalo Ny Late 1800 S With Original Wood Patina Coating Ebay

How To Calculate Sales Tax Youtube

States With The Highest And Lowest Sales Taxes

Should You Move To A State With No Income Tax Moving Com

Is Saas Taxable In New York Taxjar

Sales Tax Calculator And Rate Lookup Tool Avalara

How To Charge Your Customers The Correct Sales Tax Rates

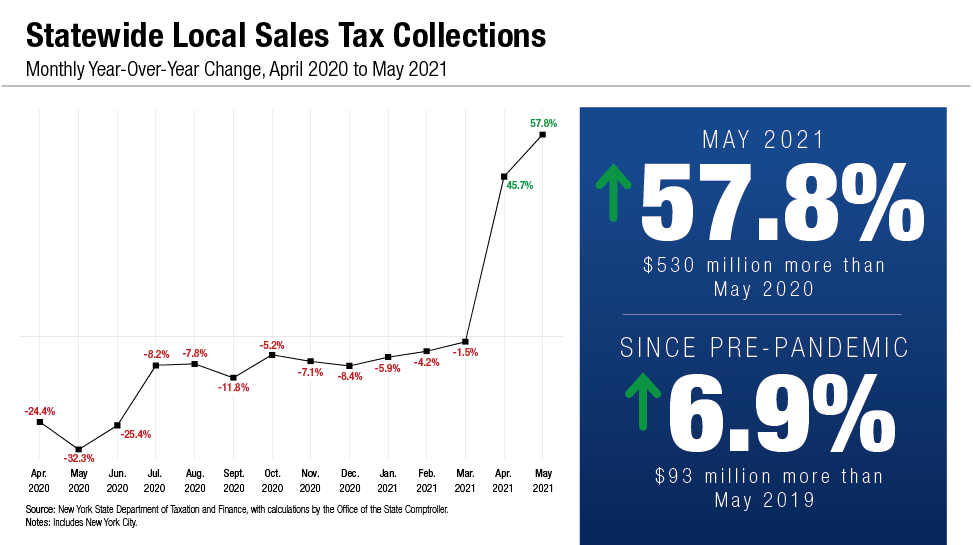

Dinapoli Statewide Local Sales Tax Collections Surge Nearly 58 Percent In May Office Of The New York State Comptroller

What Are The Taxes On Selling A House In New York

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

How Much Does It Really Cost To Sell A House In New York

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Retirees Get Significant Tax Benefits In New York State Level Financial Advisors